Senators urge CFIUS probe into UAE stake in Trump-linked World Liberty Financial

Democratic senators are calling for a national security review of a major foreign investment in World Liberty Financial, the crypto firm tied to Donald Trump and his family.

Summary

- Democratic senators urged the Committee on Foreign Investment in the United States to review a reported $500 million UAE-linked stake in World Liberty Financial, citing national security concerns.

- Sens. Elizabeth Warren and Andy Kim questioned whether the deal was formally reviewed and whether foreign investors could gain board influence or access to sensitive financial data.

- The investment is reportedly tied to Sheikh Tahnoon bin Zayed Al Nahyan, with links to G42, intensifying political scrutiny as Donald Trump denies knowledge of the transaction.

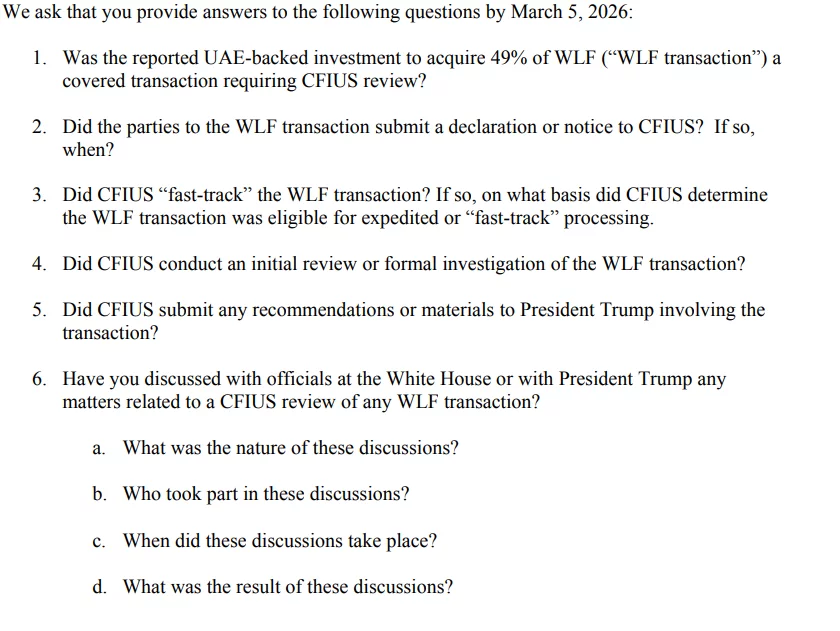

In a Feb. 13 letter to Treasury Secretary Scott Bessent, Senators Elizabeth Warren and Andy Kim urged the Committee on Foreign Investment in the United States to examine a reported $500 million stake linked to the United Arab Emirates.

The lawmakers said the investment could pose national security risks. They questioned whether CFIUS was notified. They also asked whether the deal was formally reviewed.

According to the letter, a UAE-backed entity acquired a large stake in World Liberty shortly before Trump’s January inauguration. The senators said the timing raises concerns. They warned that foreign ownership of a U.S. financial technology firm tied to a sitting president is unprecedented.

The letter sets a March deadline for answers from the Treasury.

Background and political fallout

The controversy centers on reports that an investment vehicle linked to Sheikh Tahnoon bin Zayed Al Nahyan purchased nearly half of World Liberty. Tahnoon is the UAE’s national security adviser. He is also linked to tech conglomerate G42, which has previously drawn scrutiny in Washington.

Lawmakers said the structure of the deal could give foreign actors board influence and access to sensitive financial data.

Trump has denied knowledge of the specific transaction. He said his sons manage the business. The White House has rejected claims of improper influence.

World Liberty has already faced a congressional probe over its foreign fundraising. The new letter intensifies pressure. It frames the issue as a national security matter, not just an ethics debate.

Treasury officials have not yet publicly responded.