Michigan State Pension Fund Triples Bitcoin ETF Holdings To $10.7 Million

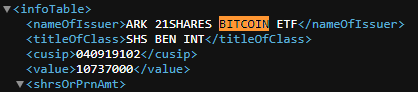

Michigan’s state pension fund has increased its exposure to Bitcoin through a significant purchase of the ARK 21Shares Bitcoin ETF (ARKB). According to a new SEC filing, the fund held 300,000 shares of ARKB as of June 30, up from 100,000 shares reported at the end of March.

The position is valued at approximately $10.7 million, compared to roughly $4.1 million three months earlier. The increase comes as spot Bitcoin ETFs continue to see inflows following their approval in January 2024.

The ARK 21Shares Bitcoin ETF is one of several spot Bitcoin funds approved by the SEC, allowing institutions to gain exposure to Bitcoin without directly holding the asset. These filings provide a window into how public funds and institutional investors are approaching Bitcoin within the framework of regulated financial products.

Michigan’s disclosure adds to a growing list of public institutions reporting Bitcoin related investments through ETFs. Earlier this year, the Wisconsin Investment Board reported positions in both the BlackRock and Grayscale Bitcoin ETFs. Similar disclosures have been made by smaller institutions, but Michigan’s filing is among the larger public pension entries.

As of today, Bitcoin is trading around $113,000 and is up approximately 21% year-to-date. The launch of spot ETFs has provided institutions with a regulated way to gain exposure. Public filings like this one suggest that traditional investors are beginning to explore Bitcoin more actively now that access has become more standardized.