Key trends driving the cross-border payments narrative for BTC, XLM, and XRP in 2026, per Toobit

Cross-border payments used to be a back-office problem. Slow rails, high fees, and too many middlemen. In 2026, attention has shifted to something practical: fixing how money moves across borders.

While retail sentiment slid into “extreme fear”, with the Crypto Fear & Greed Index dropping to 17, larger players quietly repositioned. Panic tends to be loud. Real moves usually are not.

Source: alternative.me

On platforms like Toobit, where discipline matters more than hype, the focus in 2026 is clear. It is all about settlement, liquidity, and who controls the rails.

Can Bitcoin handle the Fed?

If 2025 was all about halving hype, early 2026 has been shaped by a policy shock. The nomination of Kevin Warsh as the next Federal Reserve Chair rattled risk markets fast, and Bitcoin (BTC) did not escape the fallout. For anyone watching the current BTC price tick by tick, the message was clear: Bitcoin still reacts to liquidity shifts set by the Fed.

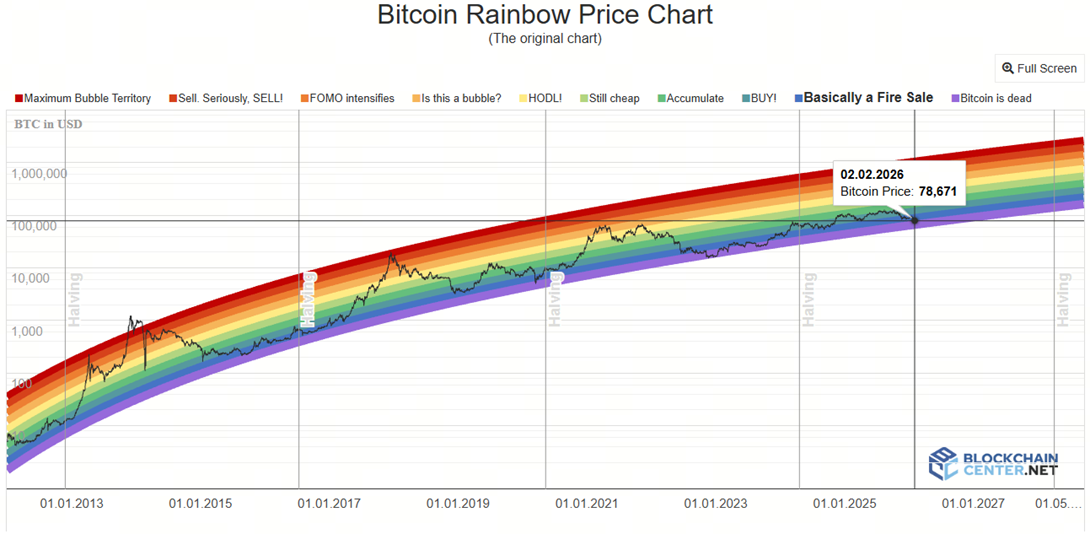

By early February 2026, the price of BTC settled around the $88,000 level, well below the highs seen late last year. Bitcoin price has since been on a downward trajectory, with BTC price trading at just below $78,000 on February 3, 2026, 02:58 (UTC +0).

The current Bitcoin price is not just about speculation; it reflects macro expectations, liquidity conditions, and institutional appetite.

The BTC rainbow chart places Bitcoin in the “Basically a Fire Sale” territory, even as sentiment sits in “Extreme Fear.” Historically, those zones have marked periods of consolidation rather than collapse. The rainbow chart BTC does not suggest a broken asset, just a market digesting macro pressure.

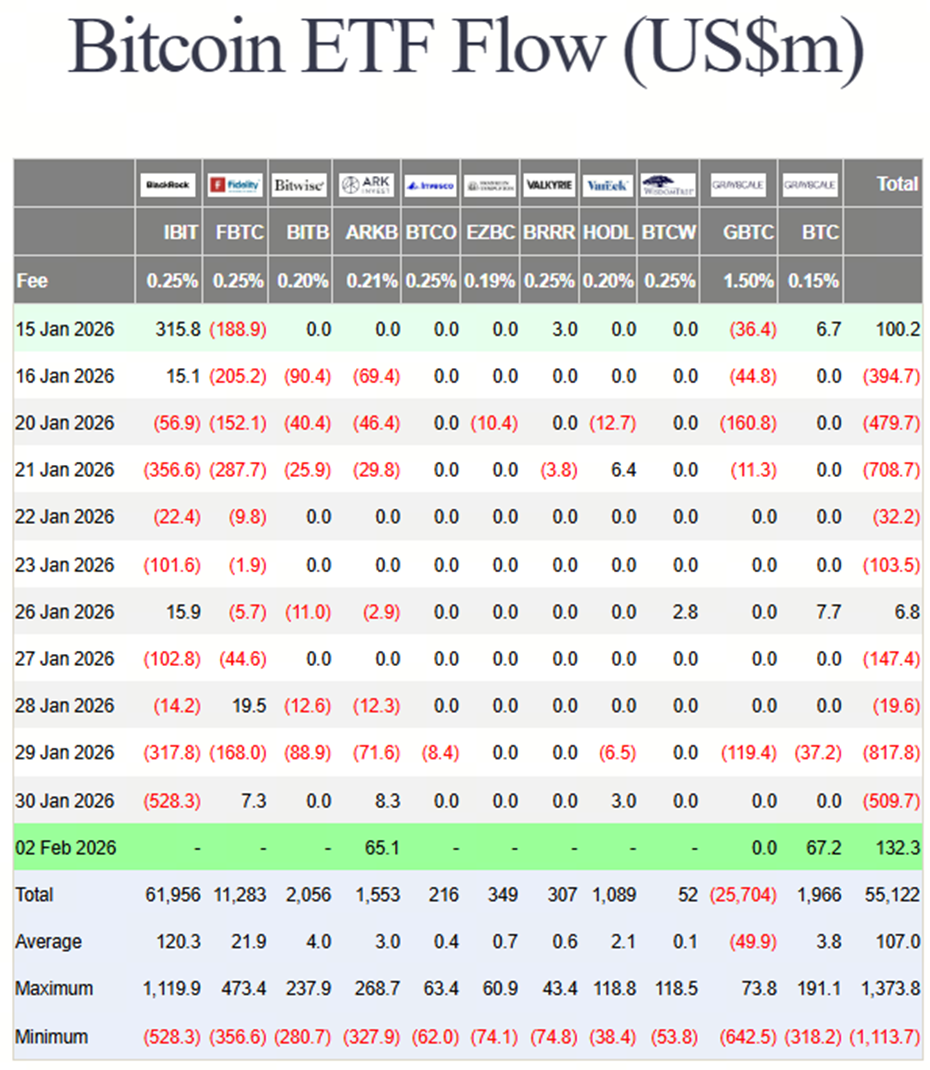

According to CoinGlass and Farside Investors’ data, Bitcoin has slipped below the average entry price of U.S. spot Bitcoin exchange-traded funds (ETFs), following two of the largest weekly outflows those products have seen since launch.

According to data reflected as of February 2, there was a net inflow of $132.2 million though it has been overshadowed by the substantial outflows just last month.

Source: Farside Investors

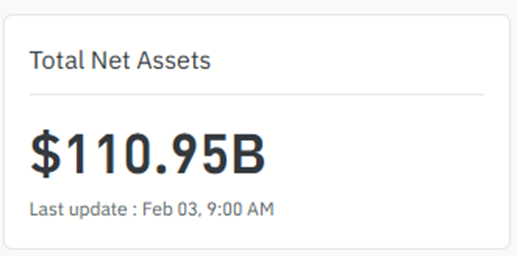

Total assets under management are hovering just above $110 billion as the recent price action points to growing pressure across the market.

However, with U.S. spot Bitcoin ETFs and growing institutional custody, BTC is increasingly treated as a neutral settlement asset rather than just a speculative trade. Large transfers across borders are using Bitcoin as a bridge asset when traditional rails are slow, expensive, or restricted.

Then as monetary policy uncertainty and geopolitical risk persist, Bitcoin’s portability matters. It allows value to move across jurisdictions without relying on correspondent banking networks, which keeps BTC relevant in cross-border flows even if it is not used for everyday payments.

That context shapes BTC price prediction discussions. Analysts are not asking whether Bitcoin survives, they are asking how central it becomes to settlement and collateral. For cross-border payments, BTC’s role is driven by institutional use, macro hedging, better infrastructure, and clearer regulation.

It is less about daily payments and more about moving large amounts of value across borders without relying on traditional banking rails.

Is Stellar Lumens the quiet engine behind global payments?

While Bitcoin wrestles with its role as a macro hedge, Stellar Lumens (XLM) has stayed focused on a simpler job: moving money across borders. That focus has helped the XLM price hold up in early 2026, driven less by speculation and more by real usage.

According to CoinMarketCap, on-chain activity and institutional partnerships expanded steadily through 2025.

Recent industry research on cross-border payments points to growing demand for faster, cheaper settlement rails, especially for business-to-business (B2B) transfers in emerging markets. That explains why the XLM Stellar price has shown relative strength even as much of the altcoin market has struggled.

When people ask, “Is XLM a good investment?”, they are often hoping for a fast breakout. That is not really the bet here. In 2026, the XLM crypto price is tied to infrastructure: transaction volume, network usage, and partnerships that do not make flashy headlines.

XLM is not trying to be digital gold. It is trying to move money cheaply across borders. Our XLM news outlook suggests price movement is increasingly linked to payment flow rather than hype cycles. As of February 3, 2026, 04:36 (UTC +0), price of XLM is trading around $0.17.

Recent XLM news prediction coverage has focused on stablecoin issuance, remittance corridors, and integrations with financial institutions in emerging markets. So if you are asking how high will XLM go, the better place to look is not social media; it is the scale of the global cross-border payments market and how much of it shifts on-chain.

According to our research of XLM crypto price behavior, Toobit observed a steady rise in wallet activity alongside modest price appreciation; often a sign of usage leading price, not the other way around. The price of XLM may not grab headlines, but it increasingly reflects real transaction demand.

Is XRP the adult in the room for cross-border payments?

The XRP price remains one of the most watched signals in cross-border payments, largely because it sits at the intersection of regulation and institutional use. Since the resolution of key legal uncertainties in the U.S., XRP price action now reflects adoption and integration rather than courtroom headlines.

Ripple continues to position XRP for settlement use cases alongside stablecoin and liquidity products designed for banks and payment providers, which has kept the XRP token price tied to real-world flows instead of short-term hype.

That is why questions like is XRP a good investment today keep resurfacing. The token price of XRP does not move in isolation; it moves on expectations of integration.

On the charts, what is XRP’s price today often reflects bursts of optimism followed by consolidation. CoinGecko data shows XRP maintaining higher baseline volumes than many large-cap peers, even outside rally periods. Price of XRP is trading at around $1.60 as of February 3, 2026, 05:01 (UTC +0).

As for XRP price prediction in 2026, expectations hinge on one thing: continued adoption in cross-border settlement. If XRP keeps taking share from legacy systems like SWIFT, price stability may matter more than dramatic spikes.

One narrative, 3 signals

So what ties BTC, XLM, and XRP together?

Cross-border payments are not about one chain winning everything. They are about layers and structure. The current BTC price tells you how much trust the market has in the system. The XLM price shows whether the rails are being used. The XRP price reflects how close institutions are to going all in.

According to data from our research, assets tied to payment infrastructure showed a higher probability of holding gains during market pullbacks compared to purely speculative tokens.

That is the shift in 2026. Markets are not chasing speed alone. They are pricing reliability.

So if you want to understand where global payments are headed, you do not need a crystal ball. You need to watch these 3 signals and understand why they move the way they do.

This article is for informational purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any decisions.

How to buy crypto on Toobit

Toobit is a fast-growing crypto exchange, built to make your trading journey super smooth. It’s secure and easy to use, whether you’re new or experienced. Plus, you can buy crypto, giving you instant access to tons of digital assets.

First, you’ll need to fund your Toobit Account, which begins by creating your account on Toobit. Registration is a 2-minute process and can be done with either email or even your Telegram account.

Navigate to the “Buy Crypto” section. From there, you can select the desired crypto and choose a payment method. Toobit offers various options, including credit card purchases through partnerships with third-party providers like Simplex and Advcash.

The platform will guide you through the remaining steps, which may involve entering payment details, confirming the transaction, and potentially completing additional verification steps.

Once the transaction is completed, return to Toobit and check your “Spot Account” to view the newly credited assets.

Congratulations, you now know how to purchase crypto on Toobit!

About Toobit

To stay updated on the latest crypto news and happenings, make sure to follow Toobit. Toobit is a leading platform for crypto trading, offering a seamless experience for both beginners and experienced traders.

With a strong focus on futures trading and derivatives trading, Toobit allows users to maximize their potential profits through leverage trading.

Traders can explore a wide range of asset staking advantage of advanced tools and risk management features. With live coin updates, where you can get the latest news on SHIB price, PEPE price, and even ETH price, Toobit does it all!

Create an account with Toobit today and find out how we offer A Bit More Than Crypto.