How To Build A Crypto Exchange App Like Binance In 2025

With Binance’s user base surpassing 240 million in 2024—and a significant 30% user increase from emerging markets—it’s clear the appetite for well-built crypto exchange platforms is stronger than ever. Demand for secure, scalable, and intuitive cryptocurrency trading apps has reached a fever pitch. So if you’re looking to build a crypto exchange like Binance, now is truly the ideal moment. In this in-depth guide, you’ll discover how to successfully plan, develop, and launch your own crypto exchange app, tailored for 2025’s fast-evolving market expectations.

Looking to Build a Binance-Like Crypto App in 2025?

Our expert team helps you create powerful, compliant, and user-friendly crypto exchange platforms.

Why Build a Crypto Exchange Like Binance in 2025?

The numbers don’t lie. Binance, as the global heavyweight, has set the benchmark for what a robust crypto platform should deliver. Its explosive 30% user growth in new regions isn’t just a flash in the pan—it signals massive latent demand for digital finance tools, especially in economies leapfrogging legacy systems.

If you’re a business or entrepreneur eyeing the next big digital frontier, here’s why this matters:

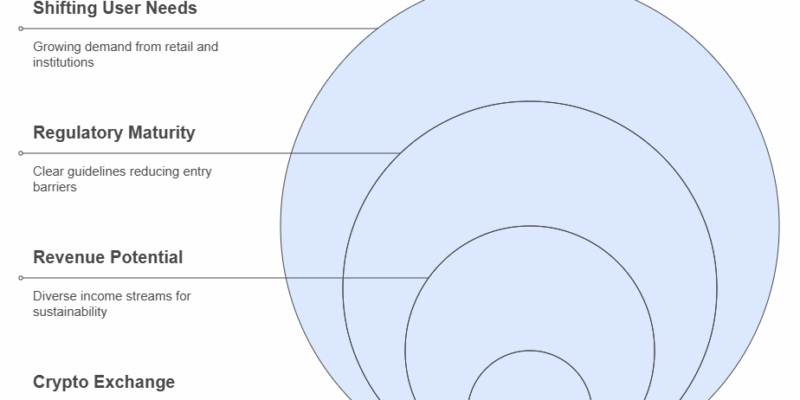

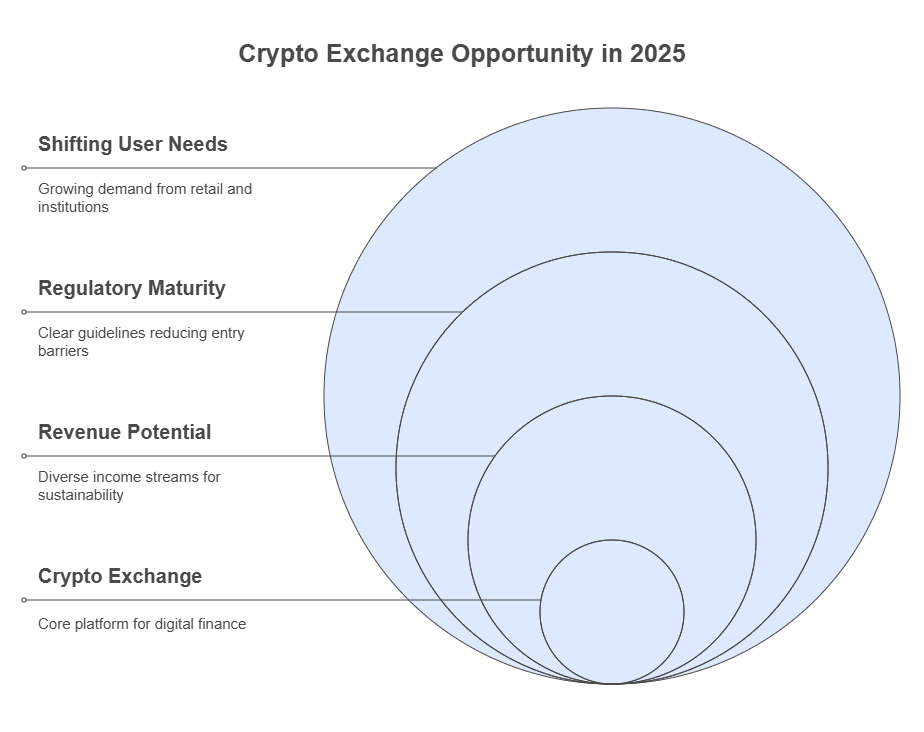

- Exploding User Base: Crypto adoption is not just a trend; it’s mainstreaming across continents.

- Shifting User Needs: With institutional onboarding doubling, both B2C and B2B demand is on the rise.

- Regulatory Maturity: More markets are laying clear guidelines, lowering entry barriers for well-prepared startups.

- Revenue Potential: Exchanges earn via trading fees, listing fees, margin products, staking, and more.

In practical terms, to build a crypto exchange like Binance is to position yourself at the intersection of finance and technology, with a very real shot at tapping into global digital economies.

But what exactly sets Binance-style platforms apart? Let’s get into the specifics.

Core Features of a Binance Clone App

When it comes to crypto exchange app development, features can make or break your user engagement. A Binance clone app incorporates a suite of best-in-class functionalities designed to attract, retain, and delight traders.

Let me explain this further: Think of your crypto platform as a digital marketplace. Much like an online stock exchange, it shouldn’t just facilitate buy/sell orders but should also create a seamless, safe, and engaging environment for various types of participants.

Must-Have Crypto Exchange Features

- User Registration & KYC: Streamlined onboarding, integrating secure ‘Know Your Customer’ (KYC) verification.

- Multi-tier Wallet Integration: Support for hot and cold wallets, including multi-currency wallets for storing diverse assets.

- Advanced Trading Engine: Real-time matching of buy/sell (bid/ask) orders, ensuring liquidity and swift transactions.

- Spot & Derivatives Trading: Allow users to trade regular spot pairs as well as futures, margin, and options contracts.

- Charting Tools: In-app analytics, real-time price charts, and indicators, mirroring what Binance users expect.

- Liquidity Management: Connection with internal order books or external liquidity pools; crucial for startup exchanges.

- Referral and Rewards Programs: Gamified incentives to boost organic platform growth and user retention.

- Robust Admin Panel: End-to-end management for listings, user actions, compliance alerts, and system monitoring.

- Push Notifications: Real-time alerts for trades, deposits, withdrawals, and security events.

- Customer Support Interface: Integrated ticketing, FAQs, and live help—a non-negotiable for today’s users.

Optional (But Impactful) Add-ons

- Staking and Earn Products

- API Access for Institutional Clients

- Mobile App for Android/iOS

- Multi-language & Multi-currency Support

- NFT Marketplace Integration

You might wonder: Do you need every single feature at launch? The answer is, not always. Prioritize features that align with your target market and regulatory constraints, and consider building out more advanced modules as you scale.

Cryptocurrency Exchange Models: Centralized vs Decentralized

Before you hit “go” on development, defining your platform’s core architecture is essential. This choice shapes not only your feature set but your entire business strategy.

Centralized Exchanges (CEX)

- Definition: A centralized crypto exchange is operated by a company that oversees transactions, manages user accounts, and holds custody of assets [think of it as similar to a bank or brokerage].

- Pros: High liquidity, faster transactions, professional customer support, regulatory control.

- Cons: Greater responsibility for compliance, higher security risks due to asset custody, more complex infrastructure.

Decentralized Exchanges (DEX)

- Definition: Decentralized Exchange development facilitate peer-to-peer trading directly on blockchain, with no central authority holding user funds.

- Pros: Enhanced privacy, no asset custody risks, often lower regulatory burdens.

- Cons: Lower liquidity (for new exchanges), UI/UX can be clunky, customer service is limited or nonexistent.

For most businesses aiming to build a crypto exchange like Binance and achieve broad-market adoption, a centralized approach is still the most feasible—at least as a starting point. Yet hybrid models are emerging as well.

A Step-by-Step Crypto Exchange App Development Guide

Building a crypto platform from scratch is no walk in the park. But breaking it down makes the process manageable. Here’s a clear path for your cryptocurrency trading app development project:

1. Discovery & Market Research

- Define core user personas (retail traders, institutions, regional focus).

- Benchmark competitors (not just Binance but also Coinbase, Kraken, etc.).

- Study your regulatory environment and market trends.

2. Requirements & Scoping

- List required crypto exchange features [see previous section].

- Decide on app architecture: centralized, decentralized, or hybrid.

- Determine integration with third-party APIs (for price feeds, KYC, payments).

3. Legal & Compliance Planning

- Work with expert advisors to obtain required licenses.

- Draft strong AML (anti-money laundering) and KYC policies.

- Design compliance workflows directly into the platform.

4. Platform Design (UX/UI)

- Prototype apps for web/mobile.

- Design intuitive dashboards, order forms, and support flows.

- Focus on accessibility and mobile experience; these will be non-negotiable for emerging market users.

5. Technical Architecture

- Choose your technology stack [see next section for tips].

- Ensure scalability, modularity, and robust database design.

6. Wallet & Custody Solutions

- Integrate secure wallet modules (hot/cold wallets).

- Explore third-party custody partners for additional security.

7. Core Development

- Set up trading engine and order book logic.

- Develop user authentication, role management, and admin controls.

- Implement wallet interactions and fiat/crypto payments.

8. Security & Testing

- Deploy comprehensive security audits (smart contracts, APIs, backend).

- Conduct penetration testing and load testing.

- Run bug bounties or invite ethical hackers to test your systems.

9. Beta Launch & Feedback

- Release MVP to a controlled group.

- Collect user feedback and refine UX/UI and features.

10. Public Launch

- Ramp up marketing, partnerships, and liquidity.

- Monitor key metrics (uptime, volume, support issues).

- Prepare for ongoing compliance checks and regular feature updates.

Building on my earlier point, one overlooked challenge is integrating liquidity early on—low liquidity can kill user trust before you even get started. Partnering with established providers or setting market-maker incentives is often critical.

Security, Compliance & Regulatory Considerations

If there’s a single area where you simply can’t afford a shortcut, it’s here. Mistakes in security or compliance can end a new exchange before it finds its stride.

Key Security Measures

- End-to-End Encryption: Encrypt user data at rest and in transit.

- Multi-Factor Authentication (MFA): Protects all logins, especially admin and withdrawal processes.

- Cold Wallet Storage: Keep most crypto reserves offline, away from hacking attempts.

- DDoS Protection and Firewalls: Shields your platform from online attacks.

- Ongoing Security Audits: Regularly hire ethical hackers to poke holes in your setup.

Regulatory Compliance Steps

- Licensing: Obtain licenses for all jurisdictions you will operate in.

- AML/KYC Protocols: Integrate ID verification and transaction monitoring systems.

- Transaction Reporting: Automate reporting for suspicious transactions.

- Transparent User Policies: Publish clear terms, privacy policy, and risk disclosures.

A practical tip from real-world exchanges? Budget for regulation costs early and maintain a compliance “war chest” for both application fees and unforeseen audits.

Common misconception: “A clone app removes all compliance headaches.” Actually, every market has unique rules. Don’t assume what works in one region will fly in another. Being proactive with legal groundwork earns trust, not just among regulators but also with your early users.

Technology Stack for Crypto Platform Development

You can’t build a crypto exchange like Binance on duct tape and glue. Here’s what a modern, scalable, and secure stack looks like:

| Layer | Core Tools/Technologies (2025 Recommended) | Comments |

|---|---|---|

| Frontend | React.js, Vue.js, Next.js | Responsive web apps; mobile: React Native/Flutter |

| Backend/API | Node.js, Go, Python, Rust | High concurrency, event-driven design preferred |

| Database | PostgreSQL, MongoDB, Redis | Relational + in-memory for speed |

| Trading Engine | Custom (C++/Rust), Matching libraries | Millisecond-level performance a must |

| Blockchain Layer | Integration via JSON-RPC, Web3.js, Ethers.js | Connects to Bitcoin, Ethereum, and other networks |

| Wallet Management | Bitgo, Fireblocks, Custom Modules | Hot/cold, multi-sig support |

| Security | Cloudflare, AWS WAF, Argon2 password hashing | Layered approach advised |

| DevOps/Hosting | AWS, Google Cloud, Azure, Kubernetes | Scale up with demand |

One quick aside: Don’t sleep on monitoring tools and incident response platforms. Downtime or performance drifts can seriously hurt user confidence.

Estimated Timeline and Investment Table

Now, let’s tackle the million-dollar (well, possibly six- or seven-figure) question: What will it take in terms of time and budget to launch your crypto exchange?

Here’s an overview based on real-world crypto exchange app development cycles:

| Stage | Estimated Duration | Budget Range (USD) |

|---|---|---|

| Discovery & Planning | 2-4 Weeks | $15,000 – $30,000 |

| Design & Prototyping | 3-6 Weeks | $20,000 – $60,000 |

| Core Development (MVP) | 3-5 Months | $150,000 – $400,000 |

| Security & Compliance Integration | 4-8 Weeks | $40,000 – $100,000 |

| Testing & Beta | 2-4 Weeks | $10,000 – $30,000 |

| Marketing & Launch | 2-6 Weeks | $25,000 – $70,000 |

| TOTAL (Initial Build) | 6-12 Months | $260,000 – $690,000 |

Turn Your Crypto Exchange Idea Into Reality

Custom-built apps with advanced trading features and bulletproof security.

Numbers are subject to scope, region, and chosen features. Too many projects ignore post-launch costs—plan for ongoing security, user support, and compliance from the outset.

Practical Tips & Lessons from the Trenches

So, what separates the exchanges that merely launch from those that thrive? A few key insights:

- Don’t Underestimate User Education: New traders get lost easily. Simple onboarding tutorials and FAQs reduce churn.

- Liquidity is King: Without early liquidity, your charts will look as flat as pancakes. Integrate with external market makers if you must.

- Design for Mobile-First: In emerging markets, the majority of users will be mobile-only. Responsive design isn’t a “nice-to-have” anymore.

- Prepare for Scale: Architect your backend so it won’t buckle if your user base doubles overnight (it does happen…).

- Fractional Integrations Are Fine: Not every blockchain or fiat integration is needed day one. Prioritize pairs and regions that fit your strategic goals.

- Community Building is Core: Discussions, AMAs, and organic referral programs can be more effective than pure ad spend.

And let’s clarify a common myth: “It’s just a matter of cloning Binance and the rest is easy.” The reality is far subtler. While Binance’s UI and major feature sets are worth referencing, your success will hinge on localization, compliance, user trust, and unique value propositions.

If you’re still with me—a quick reflection. In my own consultations, I’ve found that clients who invest early in compliance, user support, and modular, scalable tech end up avoiding the most painful pivots later on. Cutting corners just leads to paying more in the long run.

Conclusion & Next Steps

Building a crypto exchange like Binance in 2025 is both an enormous opportunity and a considerable challenge. With the crypto exchange app development market surging, it’s clear that robust, secure, and user-friendly platforms are in high demand—especially in newly emerging regions.

To recap, you’ll want to:

- Research your audience and regulatory environment intensively.

- Prioritize security, compliance, and liquidity—don’t skimp here.

- Focus on a core feature set first; scale later with add-ons.

- Invest in solid technology and reliable partners.

If launching your crypto exchange is on your 2025 roadmap, now’s the time to move from ideas to concrete plans. Strategic planning, the right technology stack, and a relentless focus on compliance and user trust will set you apart in a crowded market.

Curious about the finer points or stuck on implementation specifics? Reach out—collaborating with experienced crypto platform partners can shave months off your timeline.