Bitcoin Surges To $117K As Trump Signs 401(k) Crypto Order Plans

Bitcoin surged above $117,500 today, recovering from a local bottom of $114,278 just yesterday, according to data from Bitcoin Magazine Pro. The sharp rebound comes after President Donald Trump officially signed a landmark executive order that would allow cryptocurrencies such as Bitcoin to be included in 401(k) retirement accounts.

The order directs the Department of Labor to revisit its current guidance on fiduciary responsibilities in ERISA-governed plans and clarify the appropriate process for offering diversified funds that include alternative investments.

Additionally, the order instructs collaboration between the Department of Labor, the Treasury Department, the Securities and Exchange Commission (SEC), and other federal regulators to determine whether broader regulatory updates are needed to support the policy shift. The SEC is also specifically ordered to revise its own rules to help facilitate this access, signaling a significant move toward modernizing retirement investment options for millions of Americans.

“President Trump wants to give American workers more investment options in order to attain stronger and more financially secure retirement outcomes,” the White House fact sheet stated. “Alternative assets, such as private equity, real estate, and digital assets, offer competitive returns and diversification benefits.”

Galaxy Digital CEO Mike Novogratz underscored the impact of this, stating that a “monster pool of capital” will get exposure to Bitcoin and crypto as a result of Trump’s executive order. “Tons of money” will be pouring in, he added.

“President Trump promised to make the United States the ‘crypto capital of the world,’ emphasizing the need to embrace digital assets to drive economic growth and technological leadership,” the fact sheet concluded.

Bitwise’s Head of Research Ryan Rasmussen showed how much value this executive order could bring into bitcoin, stating, “If crypto captures X% of the $8 trillion 401k market:

1% … $80 billion

2% … $160 billion

3% … $240 billion

4% … $320 billion

5% … $400 billion

6% … $480 billion

7% … $560 billion

8% … $640 billion

9% … $720 billion

10% … $800 billion”.

This policy shift is poised to become one of the most significant catalysts for Bitcoin adoption, adding fuel to an already strong wave of institutional interest that has been building for years. According to asset manager Bitwise, while Bitcoin miners mined 217,771 BTC in 2023, institutions purchased a staggering 913,006 BTC. The trend has accelerated in 2025, with miners producing 97,082 BTC so far this year, while institutions have scooped up 545,579 BTC.

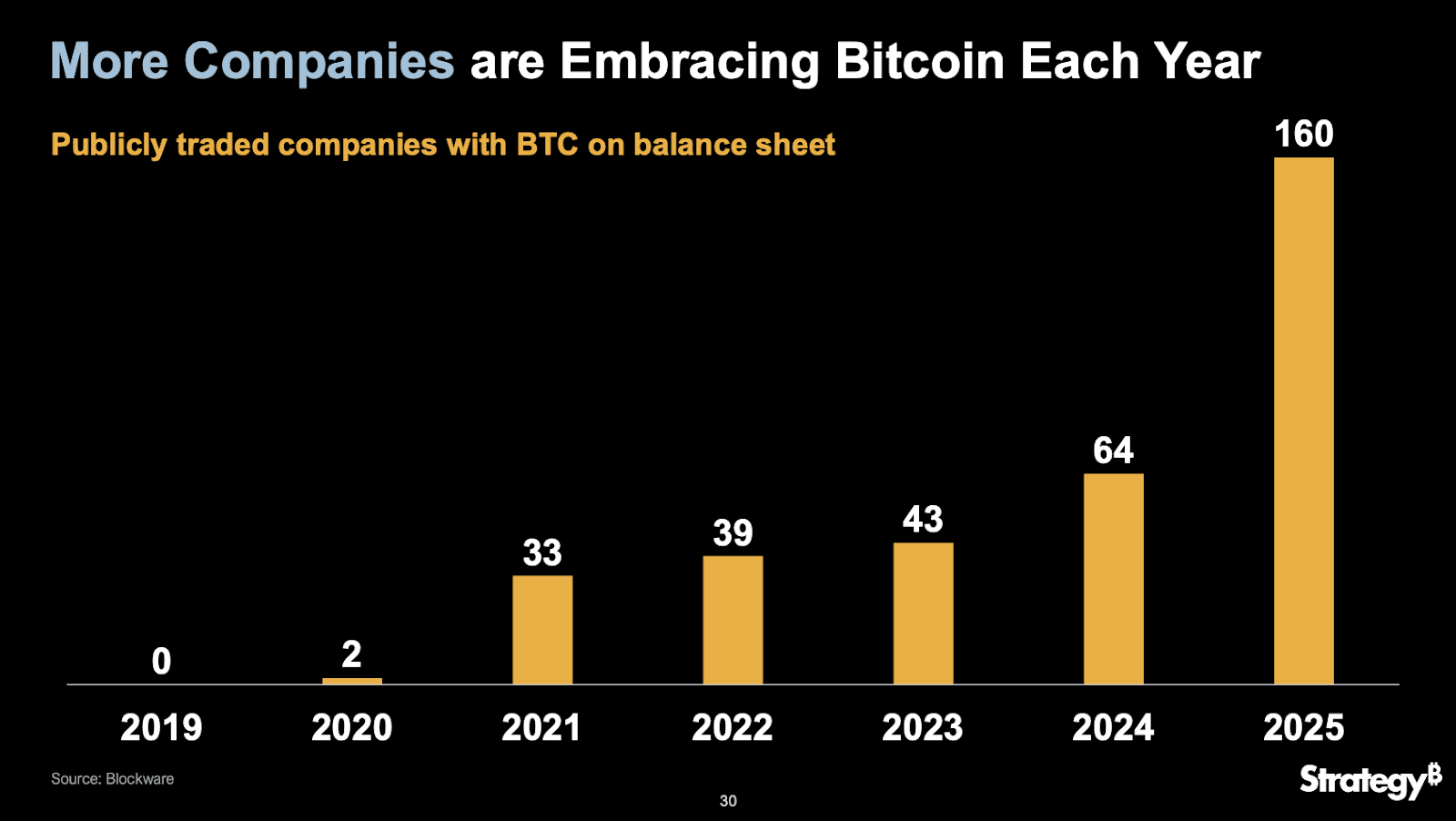

Institutional adoption continues to break records. In 2023, just 43 publicly traded companies held Bitcoin on their balance sheets. That number rose to 64 in 2024 and has now surpassed 160 in 2025, according to Blockware.

Two companies leading the new corporate Bitcoin treasury race are David Bailey’s Nakamoto and Jack Mallers’ Twenty One Capital. Nakamoto’s planned merger with KindlyMD—set for approval by Monday, August 11—would enable it to acquire hundreds of millions in bitcoin, after raising $763 million to purchase BTC for its reserves. Twenty One Capital, meanwhile, already holds 43,514 BTC, making it the third-largest corporate Bitcoin holder worldwide.

Disclosure: Nakamoto is in partnership with Bitcoin Magazine’s parent company BTC Inc to build the first global network of Bitcoin treasury companies, where BTC Inc provides certain marketing services to Nakamoto. More information on this can be found here.