Bitcoin Analysts Point to ‘Manipulation’ as BTC Price Falls to 17-Day Low

BTC’s Pullback: A Red Flag, or a Green Light?

Bitcoin (BTC), the world’s dominant cryptocurrency, recently logged its lowest daily close in over two weeks, briefly dipping below the psychological $65,000 level. As expected, this triggered a flood of bearish narratives across social media and financial headlines. Accusations of market manipulation resurfaced, with many pointing the finger at whale sell-offs, cascading long-position liquidations, and institutional market makers allegedly steering the market to shake out retail investors. But while fear rises in the short term, long-term investors and seasoned market participants are taking a different view. For them, this pullback may not be a red flag — it could very well be a green light.

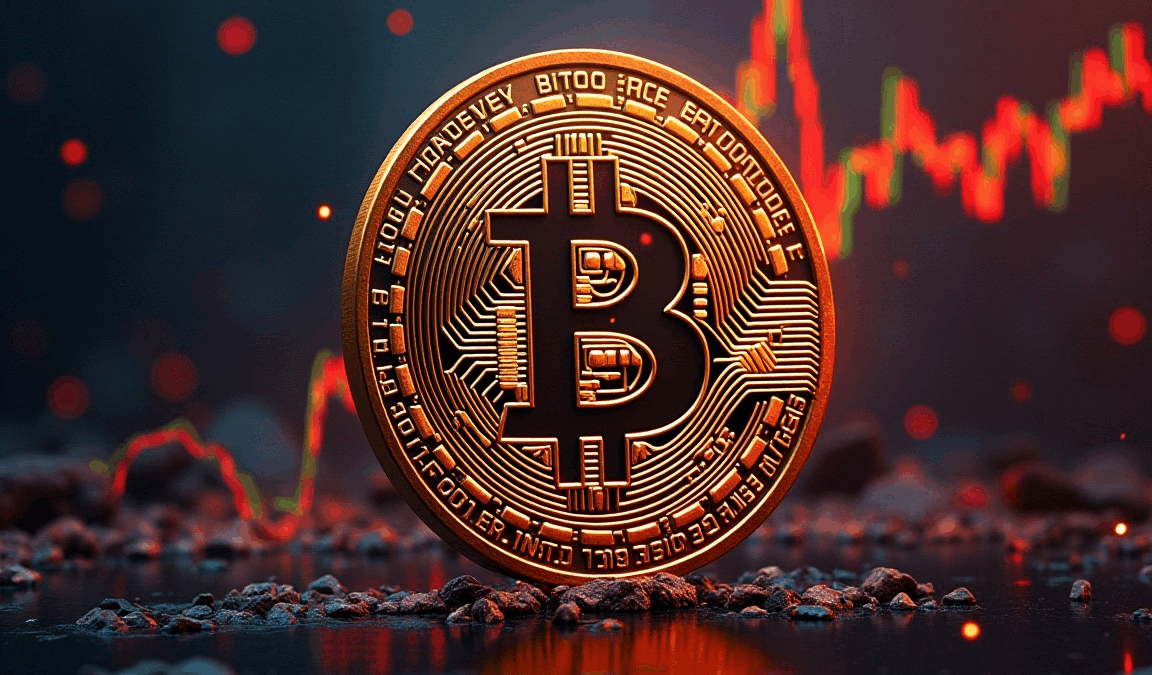

Understanding the context around these market moves is essential. Bitcoin is not immune to volatility — in fact, it’s defined by it. Every parabolic move must correct; every rally must pause and consolidate for healthy growth. So, the critical question investors should be asking is: does this dip signal deeper structural issues, or is it a natural correction in an ongoing bull market?

The Fear Narrative is an Investor’s Fuel

Fear is a powerful emotion, especially in the high-stakes world of crypto investing. But it’s important to disentangle emotion from analysis. Quick, sharp dips in Bitcoin’s price aren’t just common — they’re historically indicative of a strengthening bull market when paired with bullish fundamentals. In this case, the $65K drop may appear alarming to the untrained eye, but it hasn’t dented Bitcoin’s on-chain health.

Glassnode and other analytics platforms reveal several bullish undercurrents: long-term holders remain largely unfazed, exchange outflows continue to outpace inflows, and wallet addresses holding BTC for longer than three months continue to grow. These data points suggest the decline is being driven more by short-term sentiment than by a fundamental shift in the asset class itself.

Historically, sharp drops — often 15–25% — have characterized Bitcoin’s bull market cycles. They are the stress tests that test conviction. Every retracement knocks out the weak hands and redistributes tokens into the wallets of investors with long-term vision and strong belief in the asset class. This “reset” sets the stage for future rallies that reward the patient and penalize the panicked.

Who’s Dumping… and Who’s Buying?

Blockchain data tells a tale of two market participants. Recent data from Glassnode indicates that wallets that have held Bitcoin for less than 90 days — typically retail traders or short-term speculators — were responsible for the bulk of recent sell pressure. This cohort is often emotionally reactive, buying tops and selling bottoms, driven more by price action than analysis.

In contrast, long-term holders — those who’ve weathered previous BTC winters and who operate with a broader time horizon — are either holding strong or accumulating further. Institutional wallets, OTC desks, and addresses known for long-term accumulation are strategically positioning themselves during these price pullbacks.

This divergence is telling. In every previous bull cycle, a similar pattern emerged: short-term traders exited in fear while long-term investors accumulated. This behavior reflects an underlying confidence and is a hallmark of contrarian investing. Seasoned investors understand that price and value are not the same — and price dips can offer immense value for those willing to think beyond the current headline.

Looking Ahead: $60K as the New Launchpad?

From a technical analysis standpoint, the broader macro structure remains bullish. Bitcoin has not formed a lower low on the weekly chart, and it continues to respect the long-term trendline that has guided the asset since it broke above the $20K resistance zone in 2023. The current support range between $60,000 and $63,000 has historically served as a significant consolidation band.

The Relative Strength Index (RSI) on the weekly chart remains neutral, signaling room for upward momentum should demand re-enter the market. Furthermore, Fibonacci retracement levels drawn from recent macro lows suggest that the current dip resides within a healthy consolidation zone — not territory suggesting market collapse.

Looking at historical precedent, similar retracements during previous bull markets often preceded steep climbs. During the 2017 run, for instance, Bitcoin saw several 25%–30% dips before eventually reaching new all-time highs. The same was true in the 2020–2021 bull cycle. Each of these short-term pain points paved the way for subsequent months of explosive growth. Could $60K now serve as the base camp before another leg up? The data suggests it’s plausible.

Strategic Moves for the Contrarian Portfolio

Navigating the volatility requires more than just watching price tickers — it requires a disciplined, adaptive investing approach. Here’s how strategic crypto investors can position themselves effectively during this period:

- Scale Into BTC: Use dollar-cost averaging (DCA) to accumulate BTC during dips, especially below $65K. The $63,000 level seems to be holding well as a foundational support, making it a meaningful entry point for long-term accumulation.

- Monitor Market Dominance: Keep an eye on Bitcoin dominance, as a decline here may suggest capital rotation into altcoins. Ethereum (ETH), Solana (SOL), and emerging sectors like AI-integrated crypto projects may benefit from this rotation. Savvy investors are already tracking on-chain movement to predict where capital may flow next.

- Watch On-Chain Signals: Pay close attention to exchange flows. Declining BTC balances on exchanges typically signal intent to hold (rather than sell), while sudden surges in deposits can indicate increased selling pressure. Also monitor metrics such as the MVRV ratio (Market Value to Realized Value) and the active addresses count — both provide context as to whether the network activity supports price movement.

It’s also worthwhile to track the behavior of Grayscale Bitcoin Trust (GBTC) and other institutional investment vehicles, as discount narrowing or increased inflows often align with significant price moves. Additionally, options market sentiment, measured through funding rates and open interest changes, can offer insights into market bias among leveraged traders—often a contrarian signal if sentiment becomes frothy or overly bearish.

Conclusion: Be Greedy While Others Whisper “Manipulation”

The narrative of manipulation is not new in crypto. It tends to surface any time there’s a sharp market decline, regardless of the actual catalysts. But for disciplined investors, these emotional reactions from the crowd are often the greatest signals to pay attention. When skepticism is high and price dips, long-term investing principles suggest it might just be the best time to double down.

As Warren Buffett famously stated, “Be fearful when others are greedy, and greedy when others are fearful.” In the case of Bitcoin today, fear is again seeping into the fabric of retail sentiment — providing a potential advantage to those willing to embrace discomfort and look beyond the next 24-hour cycle.

Bitcoin’s long-term narrative — as a deflationary, decentralized, and globally adopted monetary asset — remains unbroken. The asset is maturing, institutional adoption continues to grow, and significant macroeconomic tailwinds (such as currency debasement and geopolitical uncertainty) are making its value proposition more evident than ever.

The recent dip below $65,000 could be remembered not as a sign of impending doom, but rather as a clearance event in the broader uptrend — a moment when the impatient exited and the visionary entered. Strategic accumulation, disciplined patience, and contrarian thinking continue to be the winning formula in the crypto markets.