How Much Does It Cost To Develop A Crypto Exchange In 2025?

Understanding the Quest to Build a Crypto Exchange

When we talk about the “cost to develop a crypto exchange,” we’re really talking about how many resources are poured into several crucial areas. And these days, as the crypto market matures, building an exchange isn’t just about coding a website. It’s about weaving together user-friendly design, top-notch security standards, robust trading features, compliance measures, and an efficient operational strategy.

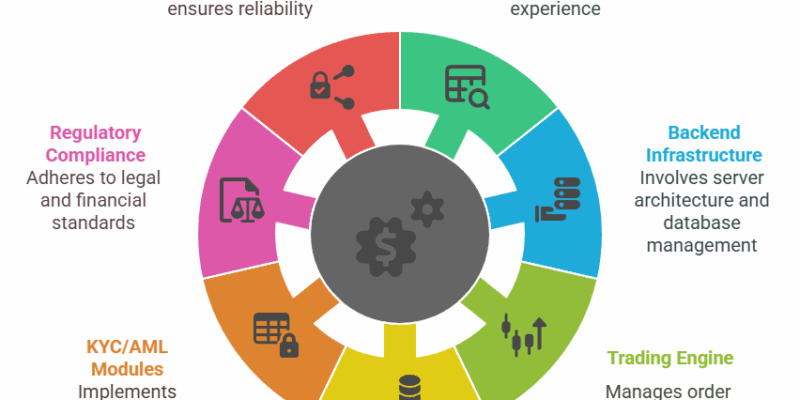

Briefly, here are the core areas that will shape your crypto exchange development cost:

- Platform Design and User Experience

- Backend Infrastructure

- Trading Engine

- Liquidity Integration

- KYC/AML Modules

- Regulatory Compliance

- Security and Testing

Each of these items contributes to that final figure. If you’re trying to estimate the cost to launch a crypto exchange in 2025, you’ll need to factor in all of these. The more complexity you introduce (like advanced trading pair configurations or algorithmic trading), the higher your exchange app development expenses climb.

1. Platform Design and User Experience

At first glance, good design might look like a “nice-to-have,” but it can be a real game-changer. A visually appealing platform that’s easy to navigate can set your exchange apart. If your exchange layout feels cumbersome or confusing, prospective traders may sign up elsewhere faster than you can say “login button.”

- Basic Design [approx. $3,000 – $7,000]: This covers a simple interface and fundamental front-end elements.

- Advanced UI/UX [approx. $8,000 – $20,000+]: This level of effort includes custom design elements, animated transitions, user onboarding flows, and thorough user testing.

One might wonder: Is it possible to cut costs by skipping elaborate design? The answer is yes, but you risk alienating users with a subpar experience. I’d strongly recommend investing thoughtfully in UI/UX because even the most sophisticated trading engine won’t matter if people can’t navigate your exchange with ease.

2. Backend Infrastructure and Architecture

Many business owners think of the visual design first, but the true heavy lifting happens in the backend. This component is often where the majority of your crypto exchange development cost is allocated. Here’s why: the backend must handle real-time data requests, process a large volume of transactions per second, and maintain ironclad security.

Building a robust backend means leveraging programming languages, frameworks, and servers that can handle high throughput. If your platform is intended for enterprise-level operations, the backend architecture needs to be both scalable and fault-tolerant. For example, microservices-based architectures—where the exchange is broken down into many individual services—are becoming increasingly popular. This approach allows each service to scale independently without taking down the entire system.

- Basic Backend Setup [approx. $5,000 – $15,000]: Suitable for smaller exchanges aiming to serve a niche market with moderate transaction volumes.

- Advanced Backend Infrastructure [approx. $20,000 – $50,000+]: This includes high-scale architecture designed for very large user bases, real-time processing, load balancing, database replication, and advanced caching mechanisms.

3. The Trading Engine

At the heart of any cryptocurrency exchange is its trading engine. This is the component that matches buy and sell orders, processes transactions, and maintains user balances. It must be accurate and consistently reliable, given that even a small glitch could lead to disgruntled traders or, worse, financial discrepancies.

- Core Trading Engine Components: Matching algorithms, order books, transaction histories, fee calculations, and real-time updates.

- Additional Features: Margin trading, automated (algorithmic) trading, advanced charting, futures contracts, and more.

Trading engines can range from relatively straightforward to highly complex. A smaller exchange might only operate with a single trading pair and simple limit orders. Meanwhile, a larger exchange could encompass multiple trading pairs, margin capabilities, and possibly even leveraged tokens. Each feature you add will increase the exchange app development expenses.

4. Liquidity Integration

Liquidity refers to how easily you can buy or sell an asset without drastically affecting its price. An exchange with little or no liquidity is about as appealing as a party with no snacks. Users may log in, but once they see that no one’s trading, they’ll quickly leave.

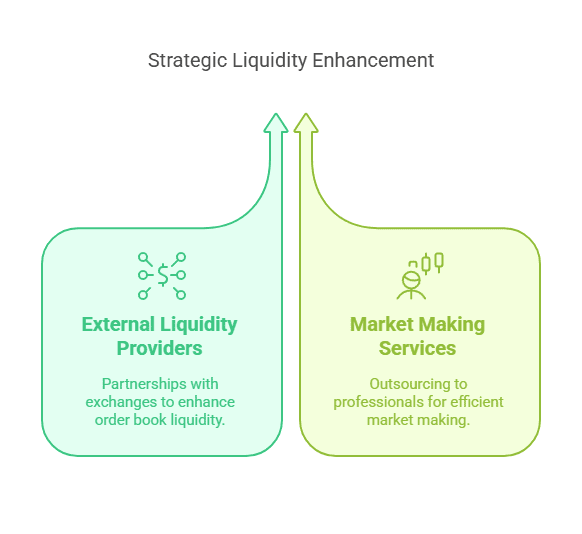

Liquidity can be improved in several ways:

- Connecting to External Liquidity Providers: This often involves forging partnerships with other exchanges or brokers to pool order books.

- Market Making Services: Some businesses outsource to professional market makers.

Either route adds costs. You might pay integration fees, monthly service fees, or a portion of transactional revenue. But robust liquidity fosters trust and lively trading activity, so it’s an essential element in the cost to develop a crypto exchange.

5. KYC/AML Modules

User verification is more than just an optional layer. With global regulators casting a watchful eye on the crypto space, KYC [Know Your Customer] and AML [Anti-Money Laundering] processes have become standard. If you neglect these, you risk legal repercussions or potential fines.

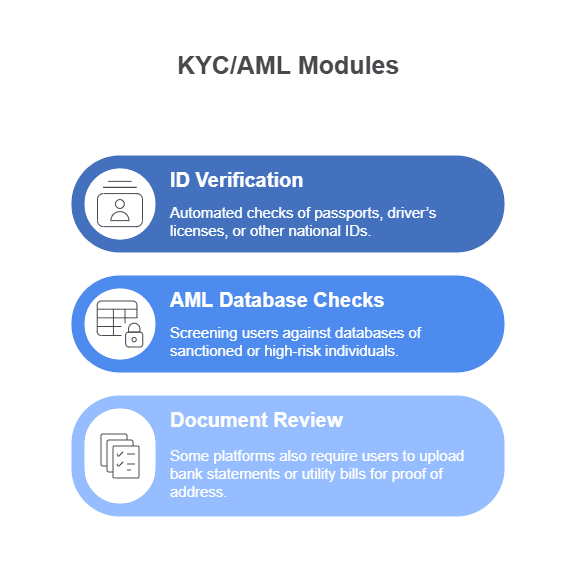

KYC/AML modules typically include:

- ID Verification: Automated checks of passports, driver’s licenses, or other national IDs.

- AML Database Checks: Screening users against databases of sanctioned or high-risk individuals.

- Document Review: Some platforms also require users to upload bank statements or utility bills for proof of address.

You can either build these modules from scratch or integrate with third-party APIs. The inclusion of automated identity verification tools will raise your cryptocurrency platform pricing breakdown. However, it also diminishes manual checks, saving you time in the long run.

6. Regulatory Compliance

Compliance stands out as a separate category from KYC/AML because it encompasses a broader set of obligations, such as registering with relevant financial authorities, adhering to data protection standards, and maintaining sufficient capital reserves in some jurisdictions. The cost to launch a crypto exchange in a heavily regulated market is significantly higher than in an area with lax regulations.

Here’s where things can get tricky: compliance budgets vary dramatically depending on your target markets. Are you planning to operate globally or just in one region? Each country has its own requirements and licensing processes, and you might need a local legal team to navigate them. Implementation delays, government fees, and annual audits [among other considerations] could all factor into your overall build crypto exchange budget.

7. Security and Testing

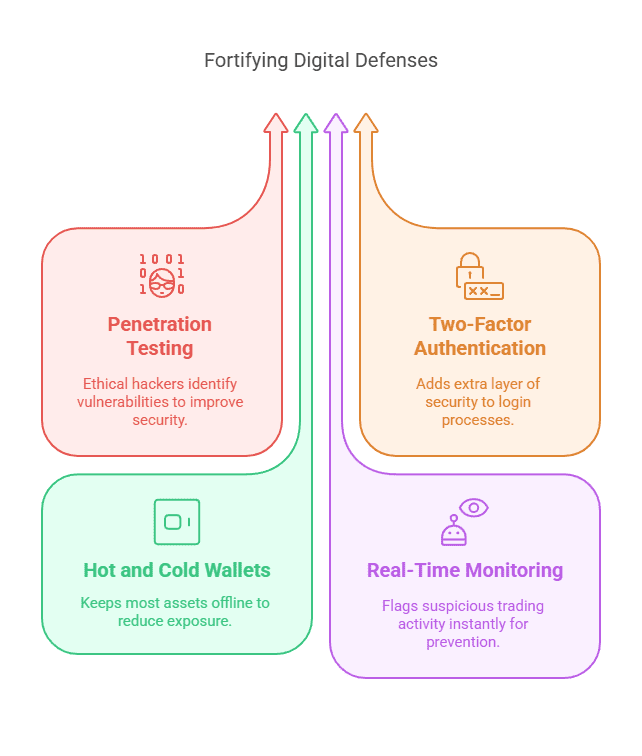

Blockchain-based assets present exciting new opportunities, but they also invite hackers looking to exploit vulnerabilities. Even established exchanges have been targeted. In some cases, stolen funds totaled millions. That’s why you’ll need advanced security measures—even if you’re working on a smaller-scale project.

Common security investments include:

- Penetration Testing: Hiring ethical hackers to spot weaknesses.

- Two-Factor Authentication: Strengthening login protocols with an additional verification method.

- Hot and Cold Wallet Architecture: Minimizing exposure of user funds by keeping most assets offline.

- Real-Time Monitoring: Using tools that immediately flag suspicious trading activity.

Yes, these measures add to your crypto trading app cost estimate, but they’re not frivolous. A single breach can evaporate trust almost instantly. Do you really want your exchange to be known for failing user security? Probably not.

Estimated Cost Breakdown Table

To provide a clearer cryptocurrency platform pricing breakdown, here’s a quick snapshot of the typical ranges you might encounter. Actual numbers may vary based on your region or the particular developers you hire, but this table gives you a rough idea.

| Component | Estimated Cost Range (USD) |

|---|---|

| Design (Basic to Advanced) | $3,000 – $20,000 |

| Backend Infrastructure | $5,000 – $50,000+ |

| Trading Engine | $10,000 – $100,000+ |

| Liquidity Integration | $5,000 – $30,000+ |

| KYC/AML Modules (3rd Party/Custom) | $2,000 – $15,000+ |

| Regulatory Compliance | $5,000 – $200,000+ |

| Security and Testing | $3,000 – $50,000+ |

Keep in mind, these numbers aren’t chiseled in stone. They’re meant to give you a ballpark of how your exchange app development expenses could add up. When you’re calculating your own cost to develop a crypto exchange, consider starting with one or two core markets and minimal features, then scaling up once you’ve validated user interest.

Additional Considerations that Influence Final Costs

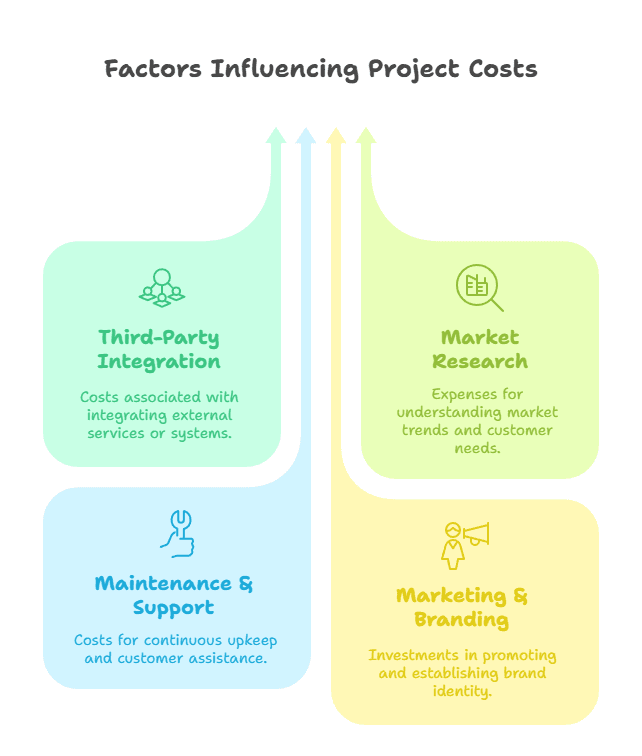

1. Third-Party Integration

Want advanced charting tools or an in-app analytics dashboard? There’s a good chance you’ll adopt third-party integration. Payment gateway setups, on-chain resource integrations, or advanced order optimization tools [often used by institutional traders] can raise your cost to launch a crypto exchange. And each integration typically has its own maintenance or licensing fees. If you remove these fancy extras, you’ll reduce your budget, but also risk limiting the appeal of your platform.

2. Market Research and Preliminary Testing

Early-phase research, which includes competitor analysis and user demand evaluation, can save you a bundle in the long term. Having a firm understanding of your target demographic’s pain points will help you fine-tune your offering. Actually, I’d refine that statement: it’ll help you design features your users truly crave, avoiding guesswork in development.

3. Ongoing Maintenance and Customer Support

Launching is only one side of the coin. Maintaining your platform day in and day out can carry ongoing costs. Software updates, bug fixes, customer tickets, and security patching all require a dedicated team (or at least some part-time support). It’s easy to overlook these expenses if you’re focusing solely on the initial cost to develop a crypto exchange, but ignoring them can lead to chaos later down the line.

4. Marketing and Branding

You can have the best-designed, most secure exchange on the planet, but if nobody knows it exists, then traffic will be fleeting. Some new exchange operators devote a portion of their build crypto exchange budget to marketing efforts, influencer partnerships, or referral programs. The amount you decide to invest in promotional activities will hinge on your go-to-market strategy. In my experience, a powerful launch campaign anchored by an authentic brand message can be integral in standing out from the competition.

Challenges in Implementation

It’s tempting to think you can just hire a few developers, spin up some servers, and be done. But that’s rarely the reality. Businesses often struggle with changing regulatory landscapes, the complexities of connecting multiple crypto assets, scaling the system to accommodate heavy loads, and ensuring 24/7 reliable support. Let’s not forget the potential difficulty of building brand credibility in a fast-paced market that’s always looking for the hottest new exchange.

One less obvious consideration is how swiftly the crypto market evolves. An exchange that looked cutting-edge one year could appear outdated just 12 months later if new features or trading experiences become standard across the industry. If you plan your strategy only for today’s conditions, you might have to shell out additional exchange app development expenses tomorrow to stay competitive.

Common Misconceptions

You might wonder, “Can I just buy a low-cost white-label solution and call it a day?” The answer is that you can purchase pre-built solutions that reduce development time. These can be excellent starting points if your budget is tight. However, you’ll still face licensing fees, customization costs, and possible security constraints. If your goal is a high-profile exchange with distinctive branding, advanced features, or specialized user flows, a quick white-label deployment might not suffice.

Another misconception is that once you handle the compliance for a single region, you’re golden worldwide. The reality is that local regulatory bodies may have drastically different requirements. If your ambition is to operate in multiple countries, you’ll need to be prepared for mounting compliance expenses, legal consultations, and possibly reconfiguring your KYC checks for each new territory.

Practical Tips for Building Your Exchange on a Budget

- Start with an MVP: Launch with essential trading features, then enhance your platform over time.

- Find the Right Development Partner: Reputable firms might charge more, but they can often save you money in the long run by delivering a stable, secure product.

- Scope Documentation: Clearly outline the features you need, especially in the early phases, to avoid rework.

- Use Reputable Components: Implement tested modules for KYC and liquidity rather than creating everything from scratch.

- Leverage Community Feedback: Engage small groups of beta testers to highlight usability issues and potential security blind spots.

As an aside, consider that each tip must be regularly revisited. You might discover that your MVP is well-received, which prompts you to expand your marketing. Or you might find that your initial liquidity strategy is weaker than expected, so you pivot to integrate an aggregator that improves your order books.

Building on Earlier Points with New Insights

One aspect we touched on earlier is the trading engine. Let’s build on that by highlighting the importance of comprehensive testing. It’s not enough to test your basic buy-sell functionality. You need to see if your engine performs consistently when the market is volatile and orders flood in at breakneck speed. If your system can’t handle that pressure, you risk meltdown during crucial trading moments. This meltdown can lead to dissatisfied customers, or worse, a tarnished reputation. And that’s not exactly a cost you can easily put a number on—though it certainly influences the broader cryptocurrency platform pricing breakdown in terms of reputational damage control.

Conclusion: Charting a Course for 2025

The cost to develop a crypto exchange varies widely based on the features you integrate, the markets you target, and the security standards you adopt. In 2025, it’s not unrealistic to see straightforward exchanges developed with $25,000, while large-scale operations might cross well over the $1 million mark once you factor in regulatory approvals and robust liquidity. Ultimately, your own crypto exchange development cost will depend on how you prioritize design, functionality, compliance, user support, and marketing.

Now, you might be thinking, “So, should I do it?” If you’re prepared to navigate the complexities of exchange app development expenses, including regulatory compliance, advanced security measures, and persistent platform upgrades, the answer is a yes. Many businesses pivot into crypto because they see potential in this emerging financial frontier. At the same time, prudence is crucial. Thorough research and a deliberate build crypto exchange budget can mitigate excessive financial risks.

If you’d like more background or want to hash out potential approaches, don’t hesitate to connect. There’s no substitute for a direct conversation with a team that has been through the process before. Each component—from your trading engine to your liquidity partnerships—will shape what you eventually pay. By breaking down your goals, analyzing your target audience, and planning each step, you can confidently handle the cost to launch a crypto exchange without overextending your resources.

And who knows? Maybe you’ll be the next name in crypto that users flock to when they’re ready to trade. In any case, understanding the core components and how they roll up into the final crypto trading app cost estimate is your first major step toward success.

About the Author

I’m the Head of Crypto Solutions at Blocktech Brew, and I’ve spent the last several years helping businesses worldwide embrace blockchain technology, develop robust crypto exchanges, and streamline digital asset operations. Our team has guided enterprises of all sizes through regulatory mazes, wallet integrations, and so much more. We’re here to help you at every stage of your crypto journey. If you’re intrigued by the possibilities, let’s talk. Your venture might be the next big leap in shaping the crypto future.

About Blocktech Brew

Blocktech Brew is a global leader in blockchain-based development and consultancy. We offer full-stack solutions—from conceptualization and development to deployment and ongoing support. Our experts stay at the cutting edge of innovation, ensuring your project benefits from the latest trends and insights in the crypto world. Reach out if you’d like to collaborate or simply learn more. We look forward to being part of your success story!