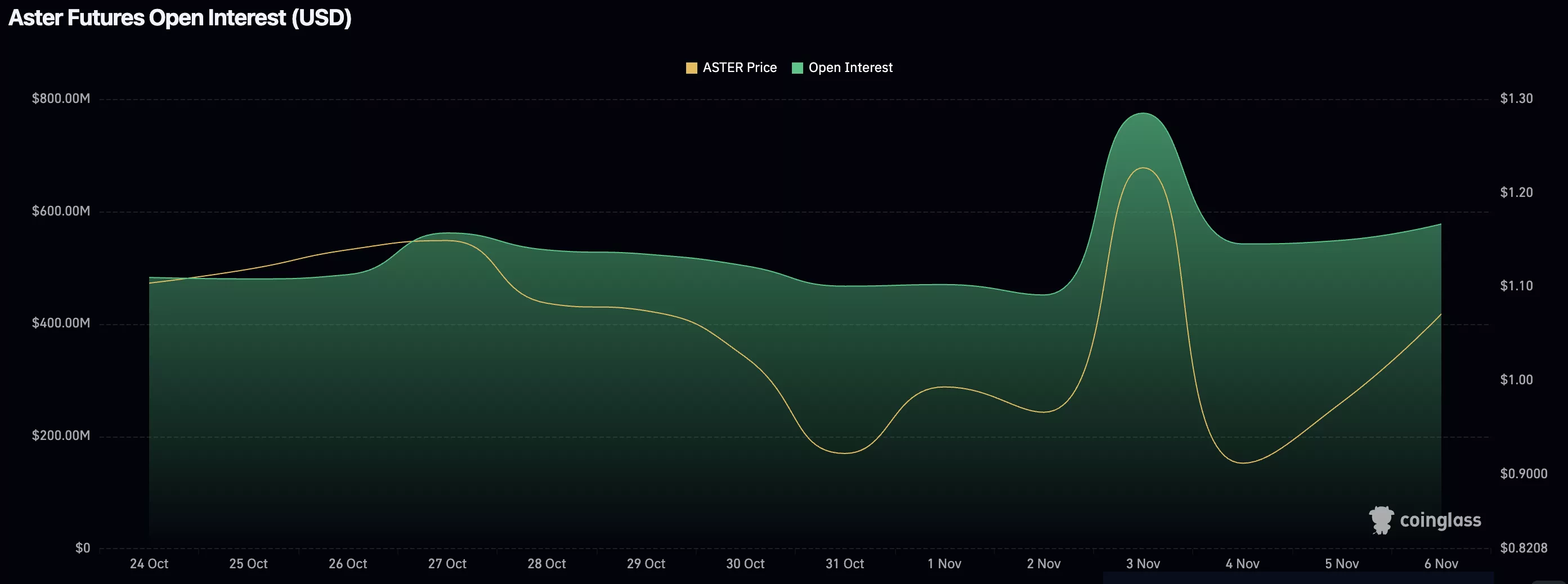

Aster price steady above $1 as Open Interest climbs

Aster price trades above $1 support as open interest climbs. Rising trader activity suggests volatility could increase as the market eyes a move toward $1.28.

Summary

- Aster holds key support at $0.93–$1.00 region with bullish confluence.

- Open interest rising, hinting at increased market volatility.

- Holding above $1 could lead to a rally toward $1.28 resistance.

Aster (ASTER) price has held above the $1 psychological level following recent volatility, signaling early signs of stabilization in a crucial technical zone. At the same time, futures open interest has begun climbing, a signal that traders are increasingly active and positioning for a potential breakout.

With both technical and derivatives data aligning, the coming days could bring a notable uptick in volatility for Aster’s price action.

Aster price key technical points:

- Major Support: $0.93 region — includes a bullish order block and 0.618 Fibonacci level.

- Resistance Target: $1.28 swing high — key level for bullish continuation.

- Market Indicator: Rising open interest signals renewed trader participation.

From a technical standpoint, Aster is trading within a key support region between $0.93 and $1.00, an area that combines several major confluences, including the 0.618 Fibonacci retracement and a bullish order block from prior price action. This structure provides a strong foundation for a potential reversal, provided that daily candles continue to close above the $0.93 support zone.

The $1 mark also acts as a critical psychological barrier, making it a vital price point for both traders and long-term investors. If Aster maintains its footing above this area, it opens the probability of a rotation toward the next significant resistance at $1.28, the previous swing high that capped recent rallies.

On the derivative side, the recent uptick in futures open interest reflects an increasing number of traders entering the market, often a precursor to heightened volatility. Rising open interest typically signals fresh capital flowing into positions, in this case, with a bullish bias, suggesting renewed optimism around Aster’s price outlook.

While this can amplify upside potential, it also increases the risk of larger swings as leveraged positions accumulate. If Aster loses its $0.93 support, liquidation pressures could trigger a quick correction. However, as long as price holds above this region, momentum appears to favor the bulls in the short term.

What to expect in the coming price action

Aster remains positioned at a key inflection point. Holding above the $1 support zone could trigger a move toward $1.28 resistance, while continued growth in open interest supports the case for a volatile breakout phase. Conversely, a daily close below $0.93 would invalidate this bullish outlook and increase downside risk.